News

The Market Rides Between Macro Data, Geopolitics, and the Fed

2+ hour, 42+ min ago (276+ words) Date: 13 Feb 2026 " 20:56 2026 is shaping up to be a year of balances. Global markets are riding this week between electoral risks, inflation data in the U.S., and geopolitical debates on security, while corporate earnings and signals from central banks add to a…...

2+ hour, 42+ min ago (276+ words) Date: 13 Feb 2026 " 20:56 2026 is shaping up to be a year of balances. Global markets are riding this week between electoral risks, inflation data in the U.S., and geopolitical debates on security, while corporate earnings and signals from central banks add to a…...

The ISM Manufacturing Index Sends Clear Signals of Recovery

1+ week, 3+ hour ago (526+ words) Date: 06 Feb 2026 " 20:30 Author: Carlos Ruiz de Antequera The first data of the year begins to confirm the impact of monetary and fiscal stimulus accumulated in Q4 2025. In particular, the January ISM Manufacturing survey delivered a positive surprise by returning to expansion…...

1+ week, 3+ hour ago (526+ words) Date: 06 Feb 2026 " 20:30 Author: Carlos Ruiz de Antequera The first data of the year begins to confirm the impact of monetary and fiscal stimulus accumulated in Q4 2025. In particular, the January ISM Manufacturing survey delivered a positive surprise by returning to expansion…...

Why Monitor the Impact of Japan's Early Election

2+ week, 1+ hour ago (309+ words) Date: 30 Jan 2026 " 21:47 To this is added the fact that, over the weekend, the country will hold early elections, which were called earlier this year by Sanae Takaishi, Prime Minister and leader of the Liberal Democratic Party of Japan (LDP). For…...

2+ week, 1+ hour ago (309+ words) Date: 30 Jan 2026 " 21:47 To this is added the fact that, over the weekend, the country will hold early elections, which were called earlier this year by Sanae Takaishi, Prime Minister and leader of the Liberal Democratic Party of Japan (LDP). For…...

Rick Rieder and the Fed: The ‘Outsider’ Candidate Who Reopens the Debate

2+ week, 1+ day ago (725+ words) Date: 29 Jan 2026 " 16:04 The possible nomination of Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock, as the next chair of the U.S. Federal Reserve has reopened debate among investors, economists, and monetary policy analysts. At stake is not just…...

2+ week, 1+ day ago (725+ words) Date: 29 Jan 2026 " 16:04 The possible nomination of Rick Rieder, Chief Investment Officer of Global Fixed Income at BlackRock, as the next chair of the U.S. Federal Reserve has reopened debate among investors, economists, and monetary policy analysts. At stake is not just…...

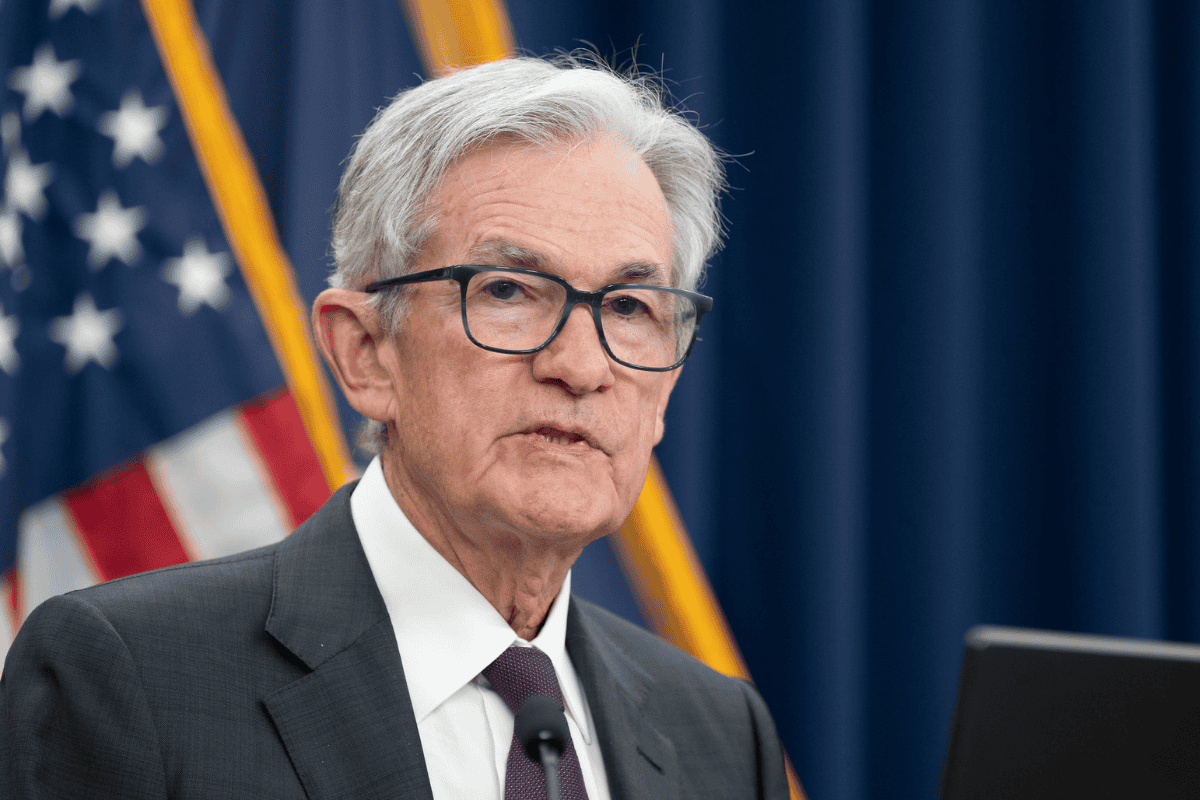

Markets on Edge Over the New Clash Between Powell and Trump

1+ mon, 10+ hour ago (294+ words) Date: 13 Jan 2026 " 13:32 Paul Donovan, Chief Economist at UBS Global Wealth Management, believes that if the move is aimed at weakening the Fed's independence, it could backfire on the administration. He speculates that Powell now has "less incentive to resign as…...

1+ mon, 10+ hour ago (294+ words) Date: 13 Jan 2026 " 13:32 Paul Donovan, Chief Economist at UBS Global Wealth Management, believes that if the move is aimed at weakening the Fed's independence, it could backfire on the administration. He speculates that Powell now has "less incentive to resign as…...

What to Expect from Central Banks in 2026?

1+ mon, 1+ week ago (502+ words) Date: 06 Jan 2026 " 13:39 After a 2025 that clearly demonstrated the diverging paths taken by various central banks around the world, all signs point to somewhat more stability in monetary policy in 2026. That said, attention remains on whether the recent arrest of Nicol's…...

Fed in the spotlight imminent rate cut - Funds Society

2+ mon, 2+ week ago (873+ words) Date: 28 Nov 2025 " 18:46 Author: Carlos Ruiz de Antequera After weeks of fragmentation within the FOMC, the market now assigns an 80% probability to a 25-basis-point cut at the December 10 meeting. The shift in expectations accelerated after rumors emerged positioning Kevin Hassett'current Director…...

Neither “Restrictive” nor “Neutral”: The ECB Strips Its Monetary Policy of Labels and Sticks to the Data - Funds Society

9+ mon, 1+ week ago (132+ words) Date: 01 May 2025 " 01:01 The European Central Bank (ECB) has responded to rising economic risks and the deterioration of financing conditions in the euro area with a new deposit rate cut to 2.25%. The decision was unanimous. However, the most noteworthy aspect was…...